Visa Survey: Hong Kong’s Affluent Prioritize Career and Income while Focused on Personal Development

06/03/2015

A focus on career advancement and annual income, coupled with an interest in recreational activities, personal development and physical fitness, points to a healthy majority of Hong Kong’s affluent hoping to maintain or increase their discretionary spending in the near future.

This is just one of the many findings reported by the 2015 Visa Affluent Survey1 (the “Study”), an annual survey of credit cardholders aged 18 through 55 conducted across the Asia Pacific region. Based on an analysis of the demographics, priorities, spending habits and economic optimism of affluent consumers in 8 Asia Pacific markets, the Study indexes their propensity to spend on discretionary and luxury items in the year to come.

According to the Study, the average age of the affluent in Hong Kong is 35, with an annual household income of US$115,450 (around HK$990,510). With the lowest marriage rate among all markets surveyed (57 percent), Hong Kong’s affluent are for the most part young, self-motivated, hard-working and focused on their careers and finances. Increasing personal income remains a key financial security goal (52 percent), followed by maximizing savings (48 percent) and planning for retirement (37 percent). While the vast majority set aside a monthly average of HK$6,600 per month for discretionary spending (84 percent), including nights out (89 percent), family holidays (79 percent) and fine dining (77 percent), they maintain that as much as 45 percent of their income currently goes into savings.

In light of these priorities, the continuing struggles of Hong Kong’s affluent to ‘switch off’ during personal time and maintain a healthy work-life balance is not surprising. The Study indicated that the majority of those surveyed work over the weekend an average of 6-8 hours per month (60 percent), with an even greater proportion handling work-related tasks during holidays (70 percent) and checking email during personal time with family (79 percent). Moreover, many of those who reported working at least one weekend a month (40 percent) claim to be busier now than in the previous year, and do not foresee their situation changing any time soon.

Still, the Study revealed that the vast majority of these individuals have gone on at least one family holiday in the past year (79 percent), with many of them traveling abroad three times. It also showed that one in four continues to value personal development outside of work (23 percent), of which almost half have taken related courses over the past year (45 percent). Most of those who have sought personal development in formal coursework are motivated by career advancement (65 percent), followed by personal interest (54 percent) and seeking a challenge (33 percent).

Commenting on the Study, Tom Tobin, Country Manager of Visa Hong Kong and Macau, said: “Hong Kong’s affluent are young, energetic and focused on career advancement. That said, they place great importance on quality time with family, spending a monthly average of HK$6,600 per month on discretionary spending for ‘nights out’ and ‘family holidays’. With a wide range of products and services, including local and overseas shopping and travel privileges as well as complimentary health club access for premium cardholders, we strive to be their ideal companion for helping them maintain a healthy lifestyle and achieve their goals.”

Finally, and despite the ongoing struggle to maintain a work-life balance, the Study also revealed that fitness and health remains a top priority for many (69 percent), with half of them doing some form of exercise at least once a week (50 percent), one in four using a personal fitness coach to help them reach their goals (24 percent), and the more tech-savvy downloading personal fitness and food consumption tracking apps (38 percent).

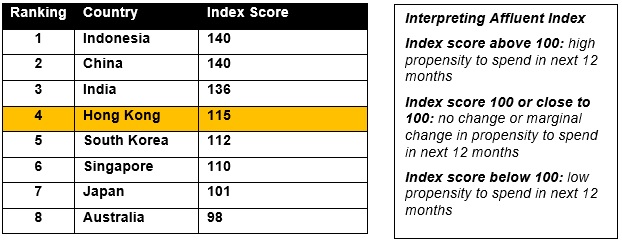

Visa Affluent Index Rankings

The Visa Affluent Index was calculated by asking respondents whether they plan to increase or decrease their discretionary spending as well as their spending on luxury items within the next 12 months. This is how each country measured up:

1 The Visa Affluent Study 2015 was conducted between November and December 2014 by TNS Singapore on behalf of Visa. The Hong Kong component of the survey studied 501 credit cardholders aged between 18 and 55, who have household income of HK$480,000 or above.

About Visa

Visa is a global payments technology company that connects consumers, businesses, financial institutions and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world’s most advanced processing networks—VisaNet—that is capable of handling more than 56,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, ahead of time with prepaid or later with credit products. For more information, visit www.visa-asia.com and @VisaNews.

About the 2015 Visa Affluent Study

The Study was conducted in November and December of 2014 by TNS Singapore on behalf of Visa Worldwide. Male and female credit cardholders aged 18 through 55 and in the top 20 percent of each country’s income distribution range (which in Hong Kong requires an annual household income of at least HK$480,000) were surveyed. In each of the eight markets, around 500 online and face-to-face interviews were conducted with representative quotas based on gender, age and income. The Study surveyed a total of 4,005 affluent consumers in countries including Australia, Japan, Korea, Hong Kong, Singapore, India, China and Indonesia.